Companies engaged in mergers and acquisitions (M&A) can significantly improve profitability by strategically managing transaction costs.

LONG BEACH, CA, February 20, 2025 /24-7PressRelease/ — Windes’ recent M&A Strategy article highlights the importance of understanding the tax implications of M&A transaction expenses, which include fees for investment bankers, attorneys, accountants, and consultants. When handled correctly, these costs can impact realized gains and offer potential tax advantages.

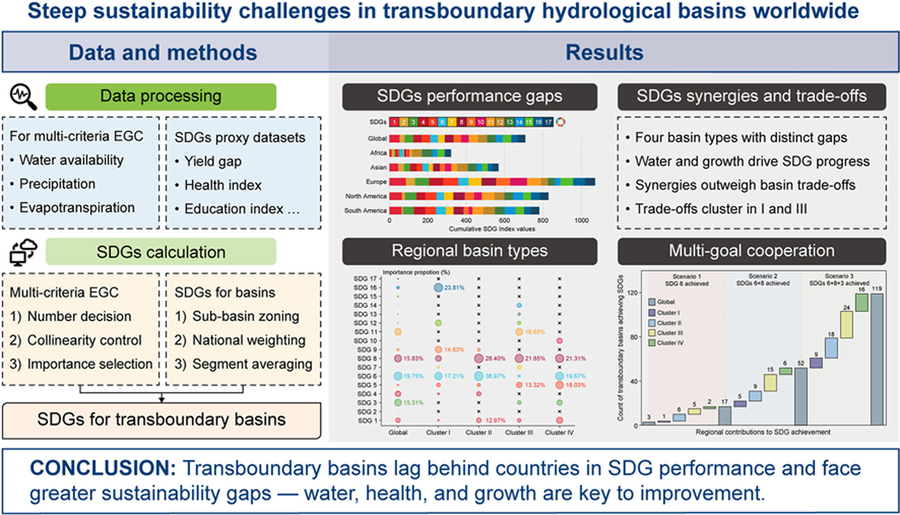

The article explains the IRS categorization of transaction costs, including capitalization rules, the “bright-line date” rule for deductibility, and the treatment of inherently facilitative costs. It also explores strategies for maximizing tax benefits, such as conducting transaction cost studies, strategically timing transactions, and meticulously categorizing expenses. Furthermore, the article emphasizes the importance of proper tax reporting and documentation, referencing ASC 740 and ASC 805 guidelines.

Readers are encouraged to access the full article: Maximize the Tax Benefits of Transaction Costs in Mergers and Acquisitions to learn more about optimizing tax strategies related to M&A transaction costs and how these strategies can contribute to increased profitability.

About Windes

Windes is a leading advisory, audit, and tax firm for growth-oriented small and mid-sized privately held companies, nonprofit organizations, and high-net-worth individuals. Our approach uses tailored expertise to proactively inform decision-making to maximize our clients’ business potential. For more information on how we can be your trusted advisor, visit us at windes.com.

—

For the original version of this press release, please visit 24-7PressRelease.com here